Payroll calculator for hourly employees

Ad Compare 10 Best Payroll Services System 2022. Remote is your experts consultant for HR benefits.

Payroll Calculator Free Employee Payroll Template For Excel

Free Unbiased Reviews Top Picks.

. If this describes your situation type in your employees gross pay. How to calculate annual income. Free Unbiased Reviews Top Picks.

Hourly Calculator Federal Hourly Paycheck Calculator or Select a state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent. Next divide this number from the annual salary. View Gross-Up Payroll Calculator Calculate.

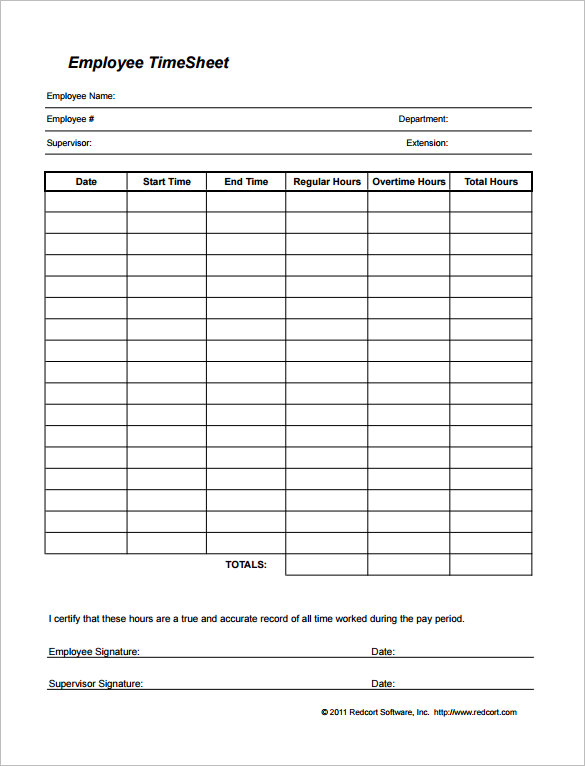

Pay information Pay type Amount Pay rate Hours worked Federal. Using The Hourly Wage Tax Calculator. Use this calculator to add up your work week time sheet and calculate work hours for payroll.

The first step in the payroll hours calculating process is to add up the total hours an employee worked during your businesss pay period. Features That Benefit Every Business. Ad Building out your global team.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees. The primary difference between payroll for hourly and salaried employees is how you calculate those gross wages in the first place. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed.

The hourly wage calculator accurately estimates net pay sometimes called take-home pay after overtime bonuses withholdings and deductions. Most employers use this paycheck calculator to calculate an employees wages for the current payroll period. 1 Calculate Total Hours Worked.

Ad Payroll Made Easy. If you arent currently using payroll software and have just a few hourly employees the free hourly paycheck calculator below can help you determine how much to withhold from. Hourly Paycheck Calculator Use the Hourly Paycheck Calculator to find out what take-home wages are every pay period for hourly employees.

Using a 30 hourly rate an average of eight hours worked each day and 260 working days a year 52 weeks multiplied by 5 working days a week the annual unadjusted salary can be. To start using The Hourly Wage Tax Calculator simply enter your hourly wage before any deductions in the Hourly wage field in the left-hand table. Gross wages for hourly employees.

Personal details Employee first name Employee last name 2. Ad Compare This Years Top 5 Free Payroll Software. This online time clock uses a standard 12-hour work clock with am and pm or a 24.

Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. Hourly Wage Calculator This hourly wage calculator helps you find out your annual monthly daily or hourly paycheck having regard to how much you are working per day week and pay rate. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general.

Make Your Payroll Effortless and Focus on What really Matters. It will confirm the deductions you include on your. For example if an employee earns 1500.

Important Note on Calculator. To try it out enter the workers details in the. First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52.

The standard FUTA tax rate is 6 so your max. Ad Compare This Years Top 5 Free Payroll Software. Fortunately you dont have to tackle.

Use Our Free Hourly Paycheck Calculator. Free Unbiased Reviews Top Picks. Paycheck calculator for hourly and salary employees 1.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. If you have hourly employees you know just how difficult it can be to manage their hours and run payroll. Simply enter their federal and state W-4 information as well as their.

Based Specialists Who Know You Your Business by Name. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Remotes EOR services include expert knowledge of benefits compliance for global teams.

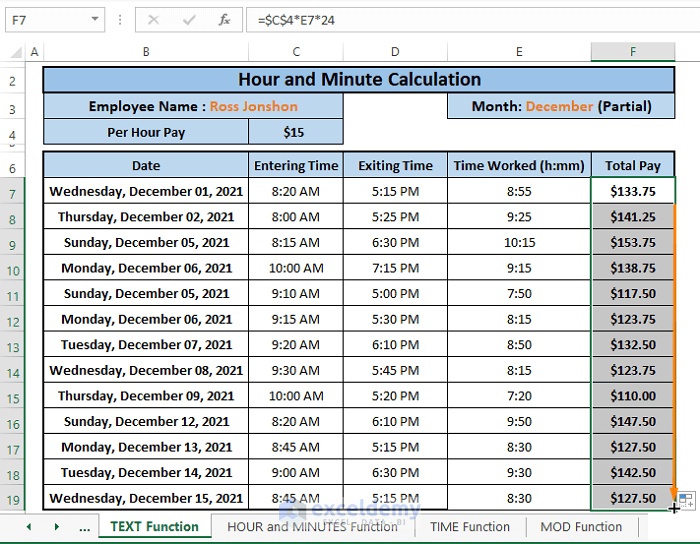

How To Calculate Hours And Minutes For Payroll Excel 7 Easy Ways

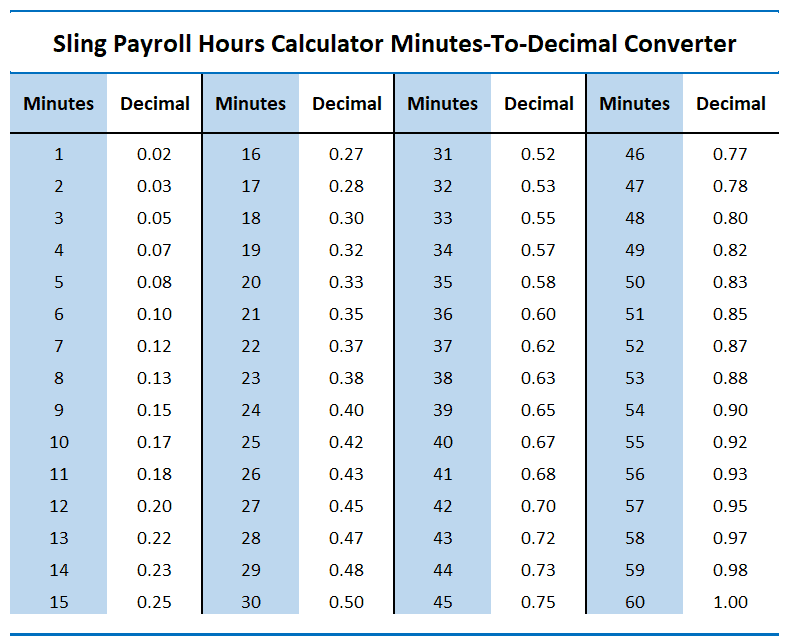

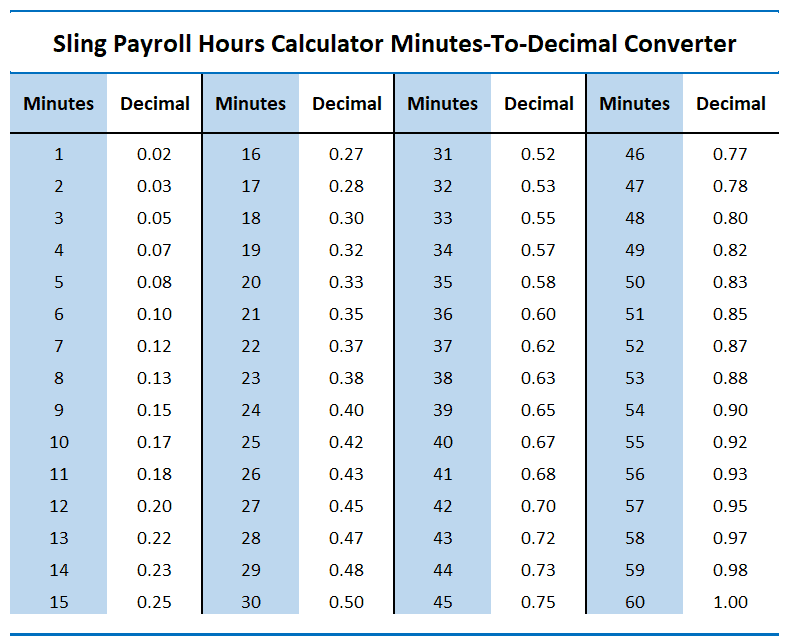

How To Calculate Payroll For Hourly Employees Sling

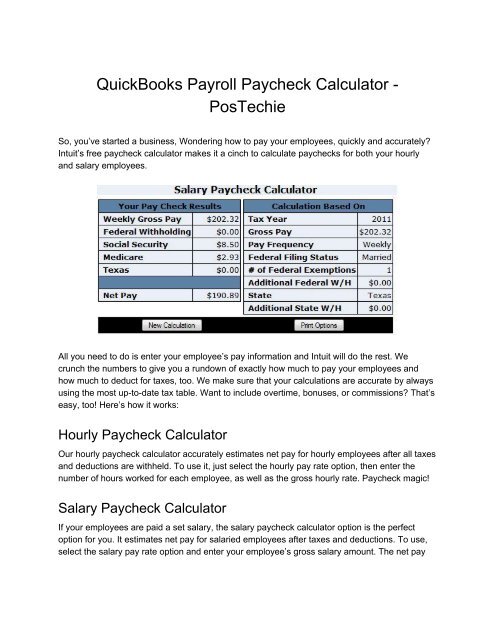

Intuit Quickbooks Payroll Paycheck Calculator Postechie For Quickbooks

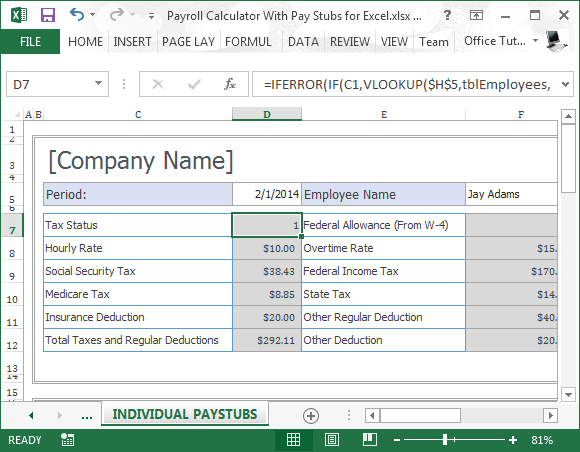

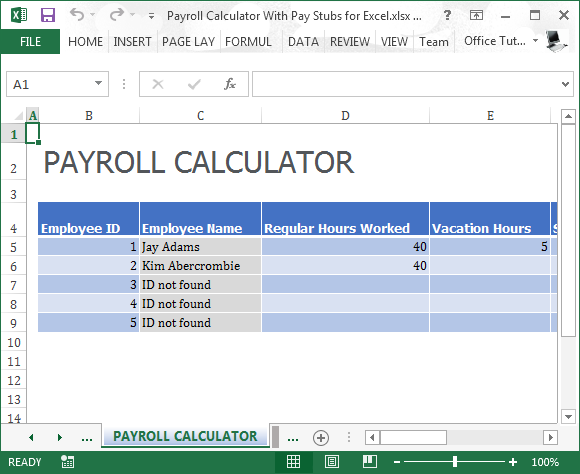

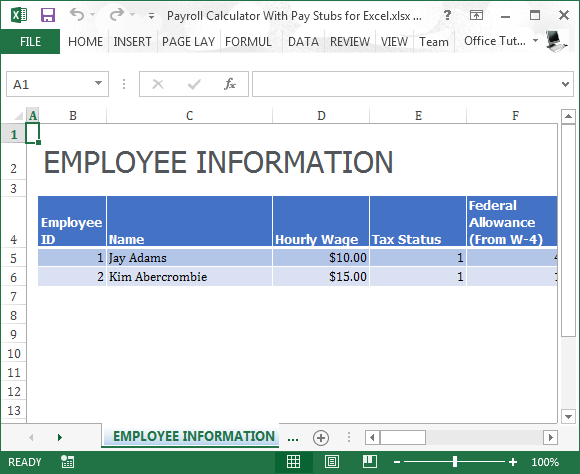

Excel Payroll Calculator With Pay Stubs Weekly Monthly

Payroll Calculator Application Devpost

8 Hourly Paycheck Calculator Doc Excel Pdf Free Premium Templates

Forecast Payroll Calculations

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

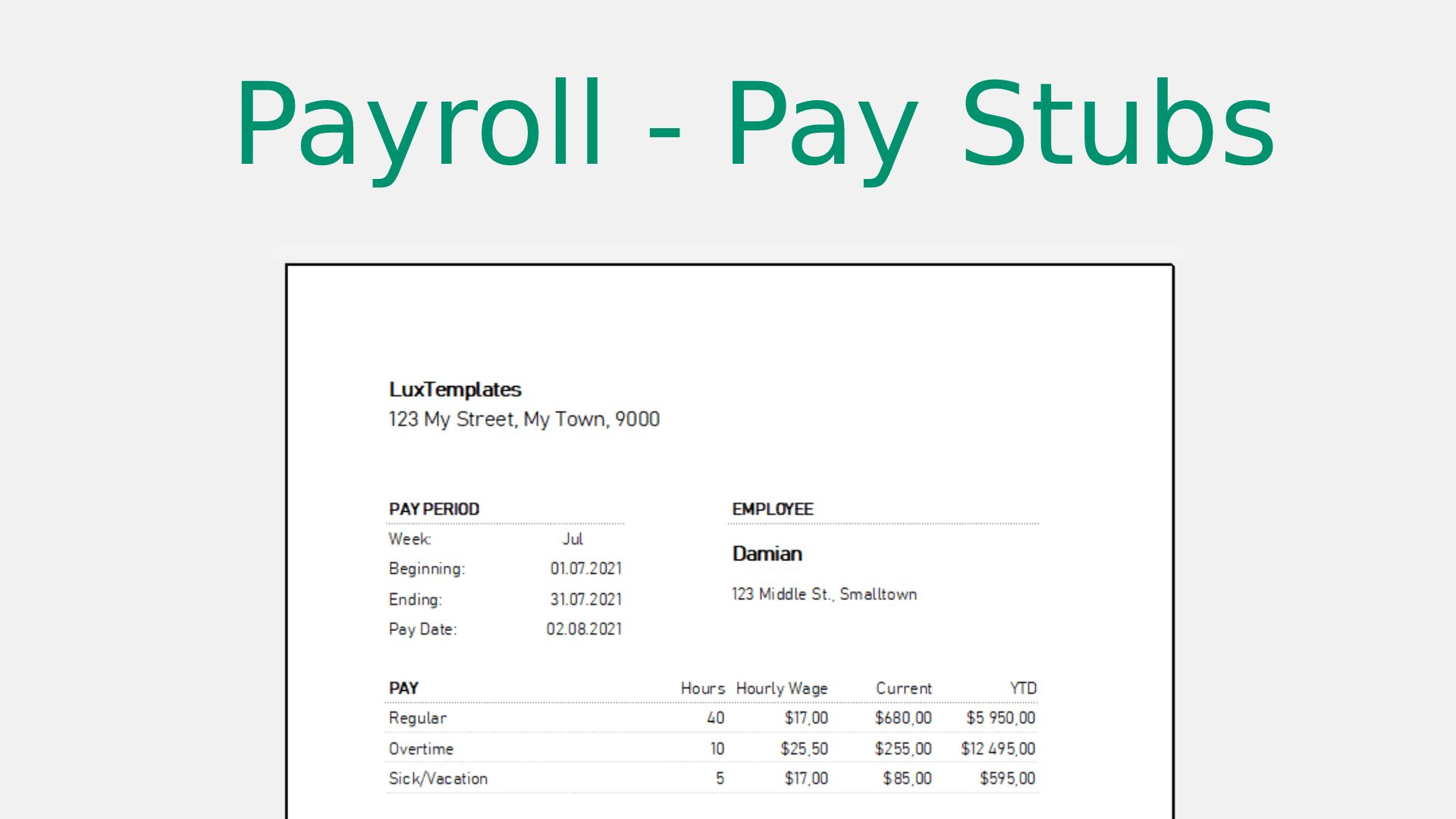

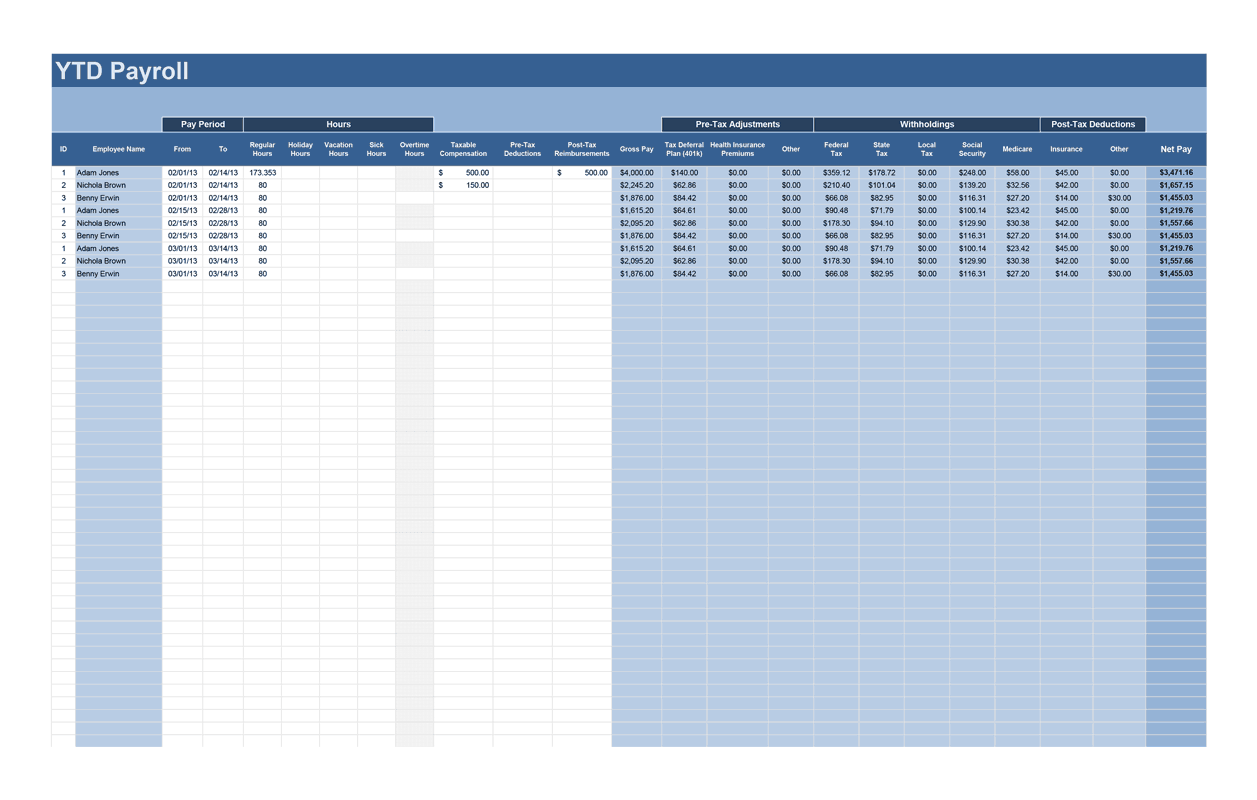

Payroll Calculator With Pay Stubs For Excel

Payroll Calculator Free Employee Payroll Template For Excel

Payroll Calculator With Pay Stubs For Excel

3 Ways To Calculate Your Hourly Rate Wikihow

How To Calculate Hours Worked Ontheclock

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

Payroll Calculator Free Employee Payroll Template For Excel

Hourly To Salary What Is My Annual Income

Payroll Calculator With Pay Stubs For Excel